Owen LansburyCo-Founder & Chair

In my recent talk at DrupalSouth Auckland 2017 I took a hard look at the hyperbole of Drupal supposedly powering over a million websites. Where does Drupal really sit in relation to other CMS platforms, both open source and proprietary? What trends are emerging that will impact Drupal's market share? The talk looked outside the Drupal bubble and took a high level view of its market potential and approaches independent firms can take to capitalise on Drupal's strengths and buffer against its potential weaknesses.

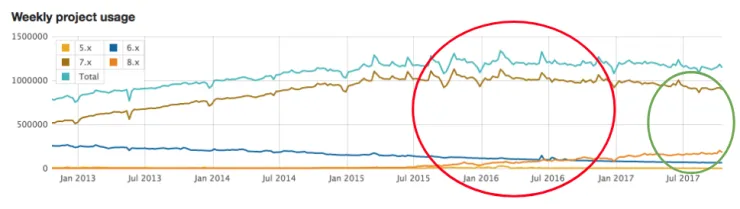

One of the key statistics that Drupalists take pride in is that it's powered over a million websites since mid 2014 when Drupal 7 was in ascendance. However, since Drupal 8 was released in late 2015, Drupal's overall use has stalled at around 1.2m websites, as seen circled in red on the Drupal Core usage statistics graph below.

The main reason for this stall in growth was that Drupal 8 was a major architectural re-write that wasn't essential or even affordable for many Drupal 7 sites to migrate to. For clients considering major new projects, many held off on committing to Drupal 8 until there were more successful case studies in the wild and didn't commission new Drupal 7 sites given that version was nearing a decade old. Anecdotally, 2016 was a tough year for many Drupal firms as they grappled with this pause in adoption.

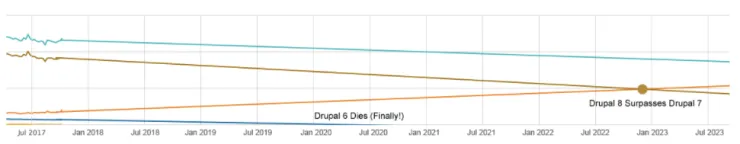

Of course, Drupal 8 is now a well-proven platform and is experiencing steady uptake, as circled in green on the usage graph above. This uptake corresponds with a down tick in Drupal 7 usage, but also indicates a softening of total Drupal usage. If we extrapolate these trend lines in a linear fashion, then we can see that Drupal 8 might surpass Drupal 7 usage around 2023.

Of course, technology adoption doesn't move in a straight line! Disruptive technologies emerge that rapidly change the playing field in a way that often can't be envisaged. The example that springs to mind is Nokia's market share was still growing when the iPhone 4 was released in 2010. By the time the iPhone 4s was released in 2011, Nokia's sales volumes had almost halved, leading to Microsoft's catastrophic purchase of the handset division in 2013 and subsequent re-sale for 5% of the purchase value in 2016. Oops!

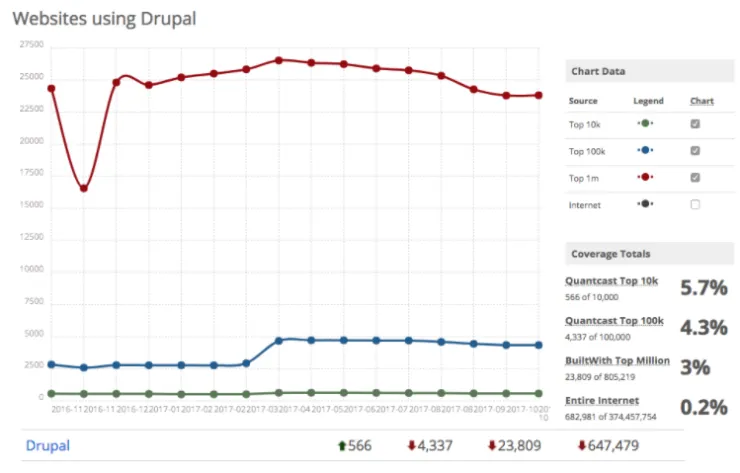

Despite this downward trend in overall Drupal usage, we can take comfort that its use on larger scale sites is growing, powering 5.7% of the Top 10,000 websites according to Builtwith.com. However, its market share of the Top 100,000 (4.3%) and Top Million (3%) websites is waning, indicating that other CMS are gaining ground with smaller sites. It's also worth noting that Builtwith only counts ~680,000 Drupal websites, indicating that the other ~500,000 Drupal.org is detecting are likely to be development and staging sites.

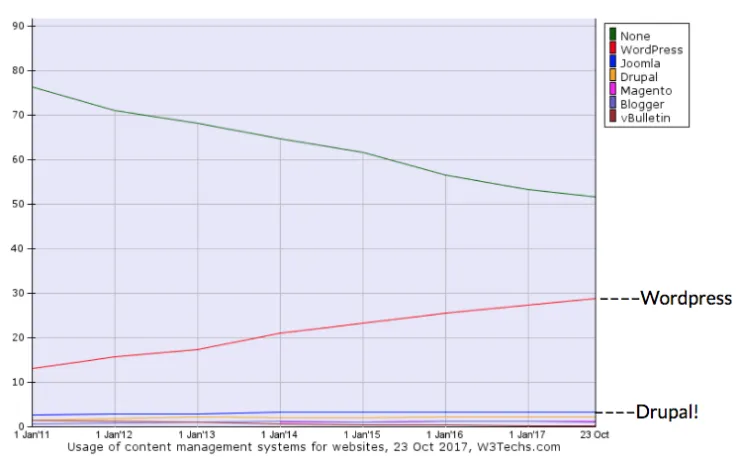

So, where are these other sites moving to when they're choosing a new CMS?

Looking at the stats from W3Techs, it's clear to see that Wordpress accounts for almost all CMS growth, now sitting at around 30% of total market share.

Wordpress has been able to achieve this dominance by being a fantastic CMS for novice developers and smaller web agencies to build clients' websites with. This is reinforced by Wordpress having an exceptional editor experience and a hugely popular SAAS platform at Wordpress.com.

The challenge Wordpress poses to other open-source CMS platforms, like Joomla, Typo3 and Plone, all with under 1% market share and falling, is their development communities are likely to starting directing their efforts to other platforms. Drupal is able to hedge against this threat by having a large and highly engaged community around Drupal 8, but it's now abundantly clear that Drupal can't compete as a platform for building smaller brochure-ware style sites that Wordpress and SAAS CMS like Squarespace are dominating. We're also seeing SAAS platforms like Nationbuilder eat significantly into Drupal's previously strong share of the non-profit sector.

In the ecommerce space, Drupal has struggled to gain much traction despite the concerted efforts of companies like the Commerce Guys. This is not to say that you can't do ecommerce with Drupal, just that SAAS offerings like Shopify, open source software like Magento and enterprise platforms like SAP are usually safer choices for most clients.

With all the hype around Headless or Decoupled CMS, Drupal 8 is well positioned to play a role as the backend for React or Angular Javascript frontends. Competitors in this space are SAAS platforms like Contentful and Directus, with proprietary platforms like Kentico pivoting as a native cloud CMS designed to power decoupled frontends.

We often talk of Drupal as a CMS Framework, where it competes against frameworks like Ruby on Rails, .NET and Django to build rich web based applications. Drupal 8 is still well placed to serve this sector if web applications are also relying on large scale content and user management features.

Which brings us to the Enterprise CMS sector, where Drupal competes head to head with proprietary platforms like Adobe Experience Manager, Sitecore and legacy products from Opentext, IBM and Oracle. The good news is that Drupal holds its own in this sector and has gained very strong market share with Government, Higher Education, Media and "Challenger" Enterprise clients.

This "Comfort zone" for Drupal usage is characterised by clients building large scale platforms with huge volumes of content and users, high scalability and integration with myriad third party products. Operationally, these clients often have well established internal web teams and varying degrees of self reliance. They're often using Agile delivery methods and place high value on speed to market and the cost savings associated with open-source software.

Where Drupal is gaining a competitive edge since the release of Drupal 8 is against proprietary Enterprise platforms like Adobe Experience Manager and Sitecore. These companies market a platform of complementary products in a unified stack to their clients through long standing partnerships with major global digital agencies and system integrators. It's no surprise then that Acquia markets their own platform in a similar way to this sector where Drupal serves as the CMS component, complemented by subscription-based tools for content personalisation, customer segmentation and cloud based managed hosting. Acquia have actively courted large digital media agencies with this offering through global partnerships to give Drupal a toe hold in this sector.

This has meant Acquia has made significant headway into larger Enterprise clients through efforts like being recognised as a "Leader" in the Gartner Magic Quadrant for CMS, lending Drupal itself some profile and legitimacy as a result. This has driven some Enterprise CIOs, CTOs and CMOs to push their vendors to offer Drupal services, who have looked to smaller Drupal firms to provide expertise where required. This is beneficial to independent Drupal services firms in the short term, but the large digital agencies will quickly internalise these skills if they see a long term market for Drupal with their global clients.

As one of those independent Drupal firms, PreviousNext have staked a bet that not all Enterprise customers will want to move to a monolithic platform where all components are provided by a single vendor's products. We're seeing sophisticated customers wanting to use Drupal 8 as the unifying hub for a range of best-of-breed SAAS platforms and cloud services.

This approach means that Enterprise customers can take advantage of the latest, greatest SAAS platforms whilst retaining control and consistency of their core CMS. It also allows for a high degree of flexibility to rapidly adapt to market changes.

The outcome of our research and analysis has led to a few key conclusions about what the future looks like for Drupal 8:

Despite the fact that we've probably already passed "Peak Drupal", we're firm believers that Drupal 8 is the right and often best tool for large scale projects and that community has the cohesion to meet to these challenges!